What Is My Marginal Tax Rate 2025. The additional 0.32% is calculated as. There are seven tax rates for the 2025 tax season:

Marginal tax rates include seven brackets 10%, 12%, 22%, 24%, 32%, 35% and 37%. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers.

Tax rates for the 2025 year of assessment Just One Lap, The federal income tax has seven tax rates in 2025: Your marginal tax rate determines what you pay when you receive the next dollar of income—it represents the highest tax rate you pay for the year.

Marginal Tax Rates StreetFins, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Simply enter your taxable income and filing status to find your top tax rate.

2025 Tax Rates & Federal Tax Brackets Top Dollar, There are seven tax brackets for most ordinary income for the 2025 tax year: These changes are now law.

Taxing The Rich The Evolution Of America’s Marginal Tax Rate, There are seven tax rates for the 2025 tax season: But some of your income will be taxed in lower tax brackets:

How To Calculate Marginal Tax Rate On, Use the income tax estimator to work out your. Here are the brackets and current rates for 2025 (applying to 2025 returns).

Marginal Tax Rate Definition TaxEDU Tax Foundation, Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year. These rates apply to your taxable income.

What Is My Tax Bracket 2025 Blue Chip Partners, Your marginal tax rate determines what you pay when you receive the next dollar of income—it represents the highest tax rate you pay for the year. Use the income tax estimator to work out your.

What Are The Different Tax Brackets 2025 Eddi Nellie, Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year. Let’s say you’re single and your 2025 taxable income is $75,000;

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, These rates apply to your taxable income. Your marginal tax rate is the highest tax rate.

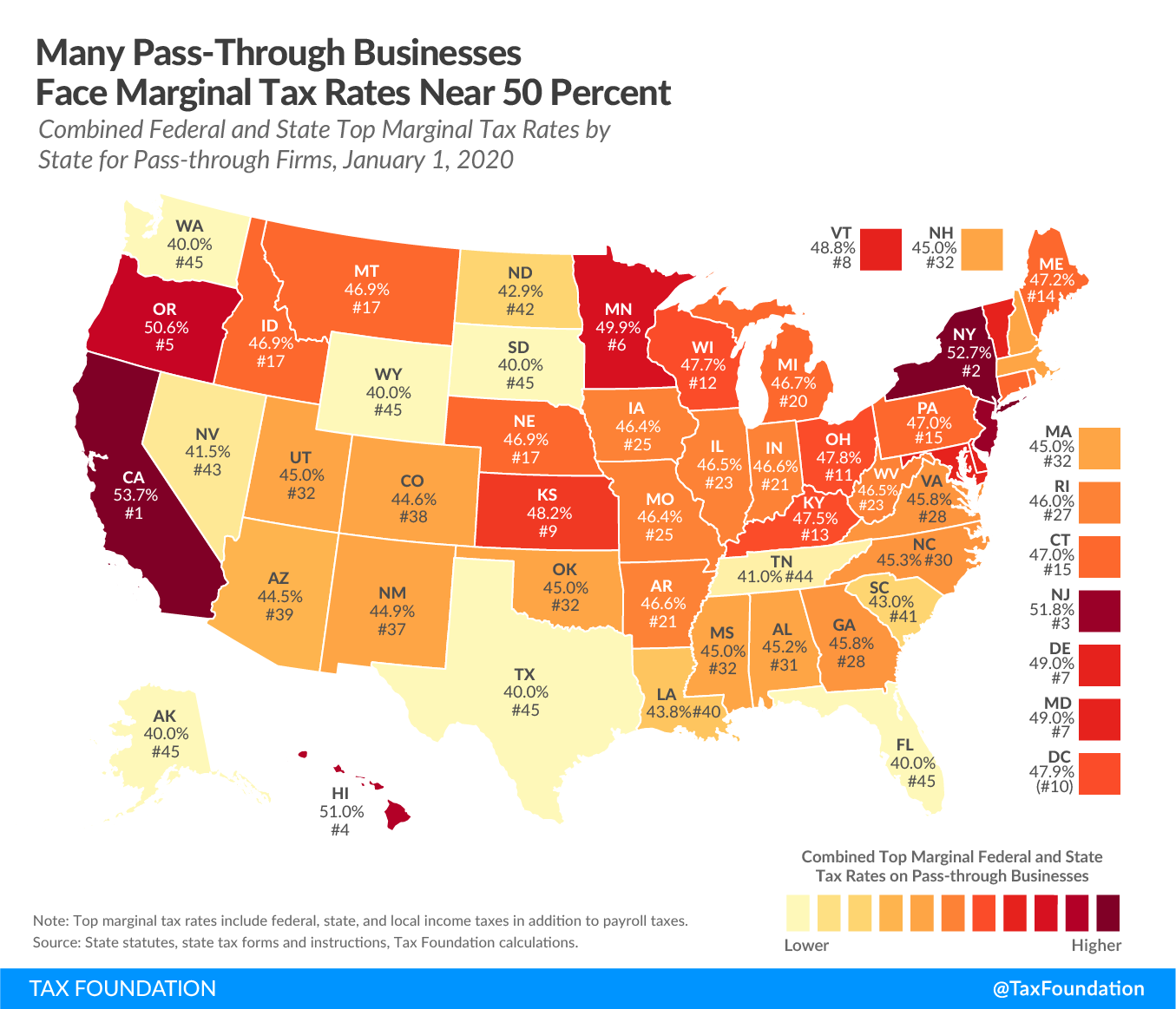

Marginal Tax Rates for Passthrough Businesses by State Upstate Tax, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. 2025 federal income tax rates.

Your marginal tax rate determines what you pay when you receive the next dollar of income—it represents the highest tax rate you pay for the year.